DID YOU KNOW Commercial Building Owners can deduct the full cost of a Commercial Roof Replacement up to $1.16M the year it’s completed or put into service?

DID YOU KNOW...

Commercial Building Owners can deduct the full cost of a Commercial Roof Replacement up to $1.16M the year it’s completed or put into service?

Big news for commercial property owners and business leaders:

The “Big Beautiful Bill” has expanded the Section 179 Tax Deduction to a staggering $2.5 million.

This means more opportunities than ever before to reinvest in your properties, improve your facilities, and dramatically reduce your taxable income.

Under this enhanced provision, businesses can immediately expense up to $2.5M in qualified capital improvements made in 2025. Eligible improvements include:

Commercial Roofing Systems – full or partial replacements

Commercial HVAC – energy-efficient systems that reduce long-term costs

Interior Build-Outs – tenant improvements, remodels, or reconfigurations

Building Envelope Restorations – windows, siding, doors, insulation, and more

Practically every significant building improvement

Financing + Insurance = Still Eligible

Even if you finance these improvements through commercial lending programs or cover them with insurance proceeds for building repairs, you can still leverage Section 179.

That means you’re not only making necessary upgrades—you’re also strategically using the tax deduction to wipe out taxable income across other areas of your business, up to the $2.5M cap.

A BRAND NEW revision represents one of the largest deductions in the history of the U.S. Commercial Building Industry!

In past years, Commercial Building Owners were required to depreciate capital improvements over 39 years.

That has all changed which now allows up to a $1,160,000 first-year deductions for improvements like Commercial Roofs, HVAC, Windows, etc.

YOU CAN ALSO WRITE-OFF COST OF THE OLD ROOF!

YOU CAN ALSO WRITE-OFF COST OF THE OLD ROOF!

This includes Assessing their Income, Investments, Deductions, and Potential Tax Credits.

This includes Assessing their Income, Investments, Deductions, and Potential Tax Credits.

If you're replacing your existing roof, you can get an additional benefit by writing off the cost of your existing roof.That means the amount remaining on your books representing the original cost of your exiting roof, less accumulated depreciation, can be taken off your books as a loss. So you're not only getting a deduction for the new roof, but also lowering as a result of any loss from writing off your existing roof.

If you're replacing your existing roof, you can get an additional benefit by writing off the cost of your existing roof.That means the amount remaining on your books representing the original cost of your exiting roof, less accumulated depreciation, can be taken off your books as a loss. So you're not only getting a deduction for the new roof, but also lowering as a result of any loss from writing off your existing roof.

BUT IT GETS EVEN BETTER!

BUT IT GETS EVEN BETTER!

You can still take the Section 179 Tax Deduction even if YOU didn't actually pay for it!

For example, the commercial roof still qualifies for the deduction even if it was paid for by the claim or third-party company.

THIS MEANS YOU CAN WIPEOUT UP TO $2.5M OF TAXABLE INCOME IN OTHER PARTS OF YOUR BUSINESS PORTFOLIO OR PASS THUR NET INCOME.

CLICK BELOW to Learn How You Can Deduct the Full Cost of Commercial Roofs!

CLICK BELOW to Learn How You Can Deduct the Full Cost of Commercial Roofs!

WHO CAN QUALIFY FOR THE DEDUCTION?

WHO CAN QUALIFY FOR THE DEDUCTION?

Retail Buildings | Office Buildings | Industrial Warehouses | Shopping Centers

🏬 🏫 🏭 🏢 🏤

Retail Buildings 🏬

Office Buildings 🏫

Industrial Buildings 🏭

Warehouses 🏢

Shopping Centers 🏤

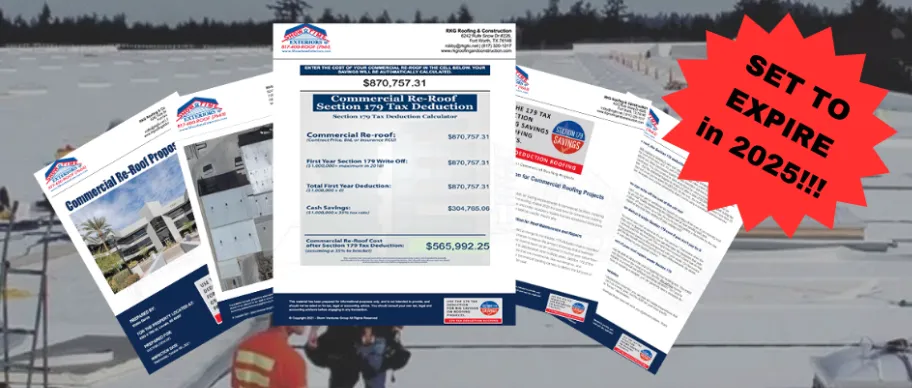

GET YOUR COMPLIMENTARY - SECTION 179 COMMERCIAL ROOF PROPOSAL!

Comes with a built-in IRS Tax Calculator to see how much you qualify for this Section 179 Deduction!